If you use Xero accounting software, Gusto will be your preferred payroll provider. We love Gusto for their simplicity, a host of great features, and an amazing support team. Gusto and Xero are deeply integrated, which makes for a smooth accounting and payroll process. Gusto automatically syncs payroll and financial data with your Xero accounting file.

To reconcile Gusto payroll transactions in Xero, follow these steps:

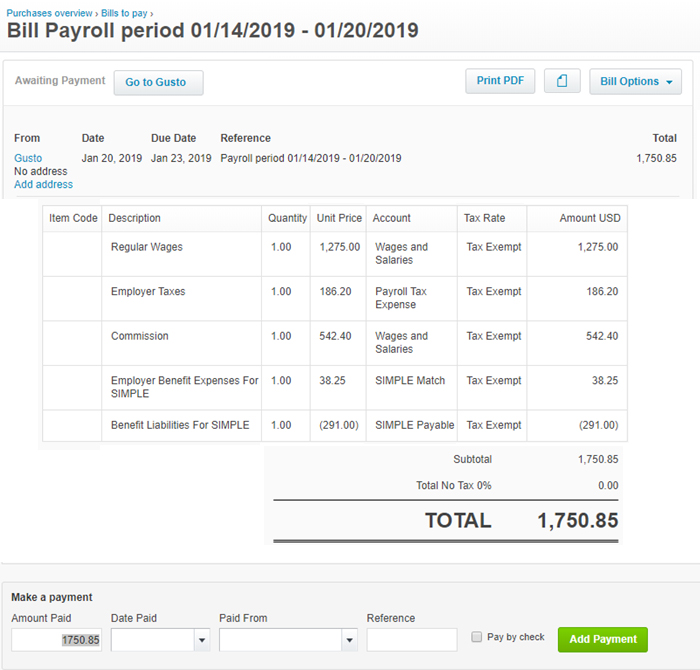

1. First, locate your recently posted Gusto bill:

Click on Bills > Locate Gusto bill you are going to reconcile > Open the bill

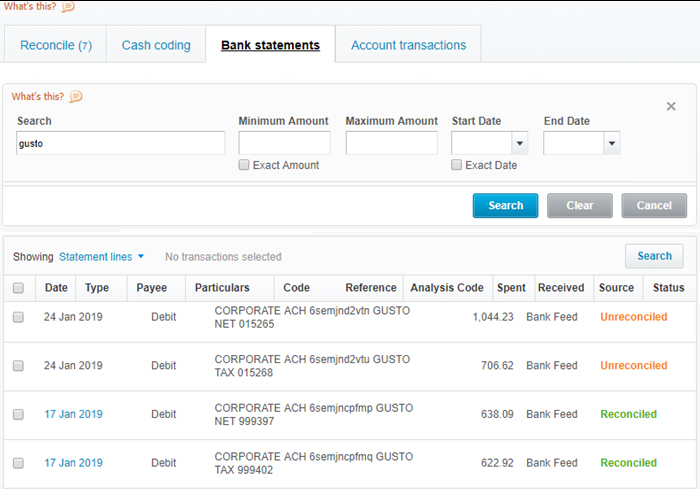

2. Open a second browser tab > Select the bank account which is used to process payroll > Click on the Bank statements tab > Locate Gusto bank feeds.

The two bank feeds should add up to the total outstanding bill. In order to reconcile these feeds, you will need to create bill payments first.

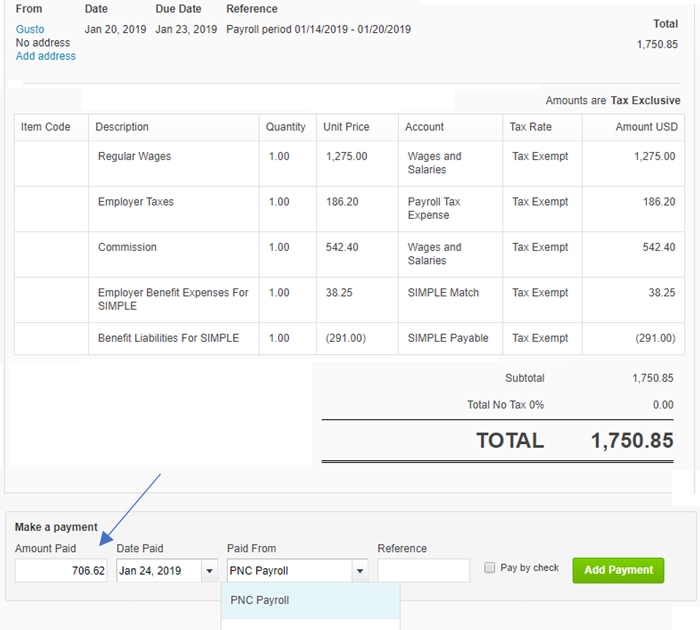

3. Go to the bill you opened and create one of those payments. In the “Amount Paid” enter one of the two bank feed amounts you located. Date paid is the same as on the bank feed date. Select the correct bank account and click “Add Payment”.

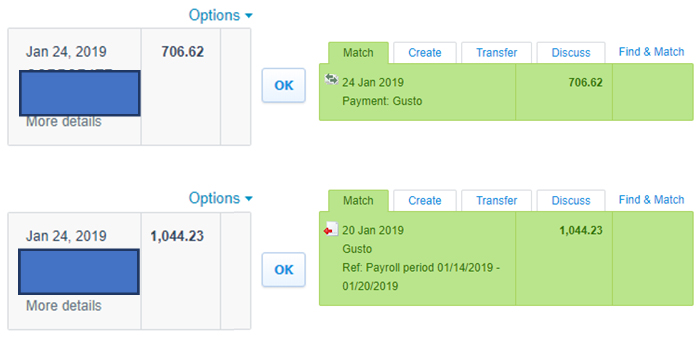

4. Go to the bank account which is used to process Payroll >Click on the Reconcile tab

and search for this payment. You will see the bank feed matches the payment you created (two green arrows on the right-hand side).

The second payment will be a suggested match in Xero (a red arrow on the right-hand side).

Xero automatically suggests the second payment match because it exactly matches the outstanding bill balance.

If you are behind on reconciling Gusto payroll in Xero, make sure you carefully match payments to the correct bills. If you mess up the dates, your Accounts Payable will be inaccurate.

One of the typical errors when reconciling Gusto payroll transactions is not applying payments to bills, but rather adding new payroll transactions from bank feeds. This error results in overstated payroll and payroll tax expense, as well as overstated Accounts Payable.